pros and cons list carbon tax

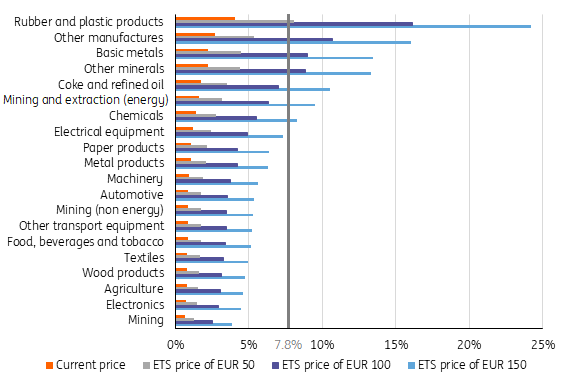

The horse-trading necessary to get a carbon tax passed might require all sorts of policy contortions. For every 10 increase in price there is an estimated 3 decrease in consumption.

27 Main Pros Cons Of Carbon Taxes E C

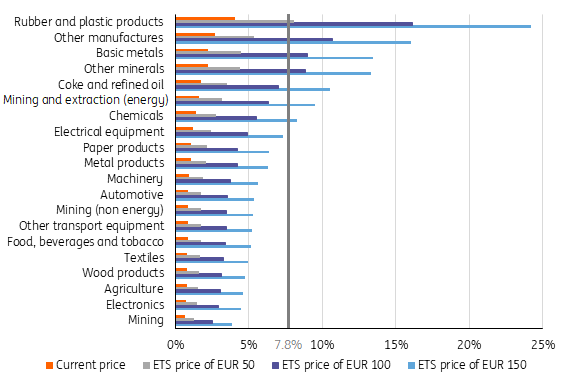

Many of the new carbon tax proposals use an emissions trading system as a primary form of income generation.

. There should be no overall increase in the tax burden. Experts often debate the pros and cons of a carbon tax versus a cap-and-trade system in the United States and they will do so again at an event in Washington DC tomorrowA carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a cap-and-trade program. An increase in the cost of fossil fuels will impose a harsh burden on low-income earners.

Carbon tax makes companies more responsible. There are quite a few pros and cons that need to be discussed. If you give a company or an individual a free hand and dont put any financial burden or accountability then the individual or company will go all guns blazing damaging the environment in the process.

CBO analyzed three possibilities. To come up with a good opinion about this subject matter on our end it is best to look at its pros and cons. It is a Pigouvian tax since it returns the.

This means the tax raised from taxing carbon emissions can be used to reduce other taxes. Carbon Tax Pros and Cons. However critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth.

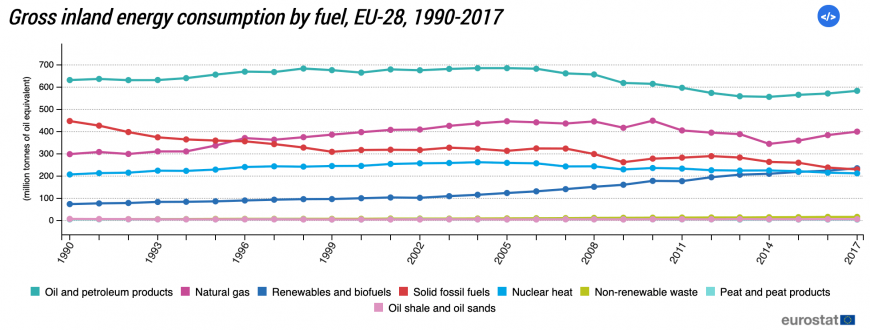

The carbon tax creates an artificial economic market that isnt always sustainable. It would raise energy prices. Making energy more expensive might do this they caution.

It is a form of carbon pricing and aims to reduce global carbon emissions in order to mitigate the global warming issue. The creation of carbon is a side effect of cost effective energy. Countries may free ride on others making efforts to reduce carbon emissions and reduce the impact of global warming.

Lower emissions mean cheaper everything allowing for greater profit margins. At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their manufacturing processes by levying a tax that increases their cost. Those costs are borne by those who suffer from the effects such as homeowners farmers and ultimately the government.

Carbon taxes make sure companies and consumers pay for the external costs they impose on society. It encourages people to find alternative. Further opponents point out that all taxes have distortionary effects affecting free-market decisions and perhaps reducing gross domestic product growth.

By imposing a tax you are making a. When consumers are asked to pay more without holding businesses responsible for their involvement then this idea struggles to gain traction. The aim is to increase social efficiency by making people aware of the full social cost.

Using the carbon tax revenues to reduce deficits says CBO would decrease the taxs total costs to the. The system needs to be employed by law similar to other sin taxes on alcohol tobaccos and even sales taxes. List of Advantages of Carbon Tax 1.

The design of a carbon tax allows it to provide multiple benefits. To implement a carbon tax the government needs a huge amount of capital. Although the carbon tax has some important advantages it also implies some problems.

CO2 taxes often apply when triggering thresholds get reached through mining production or fabrications activities. When a carbon tax is implemented there are two potential benefits to consider with this legislation. List of Pros of Carbon Tax.

A carbon tax would help to subsidize research in these fields and perhaps a way could be found to repair the damage caused to. There is the possibility to experience a financial return for households who limit their fossil fuel consumption in the form of credits. Unfortunately this would also create a major disadvantage as the carbon tax will most likely hurt.

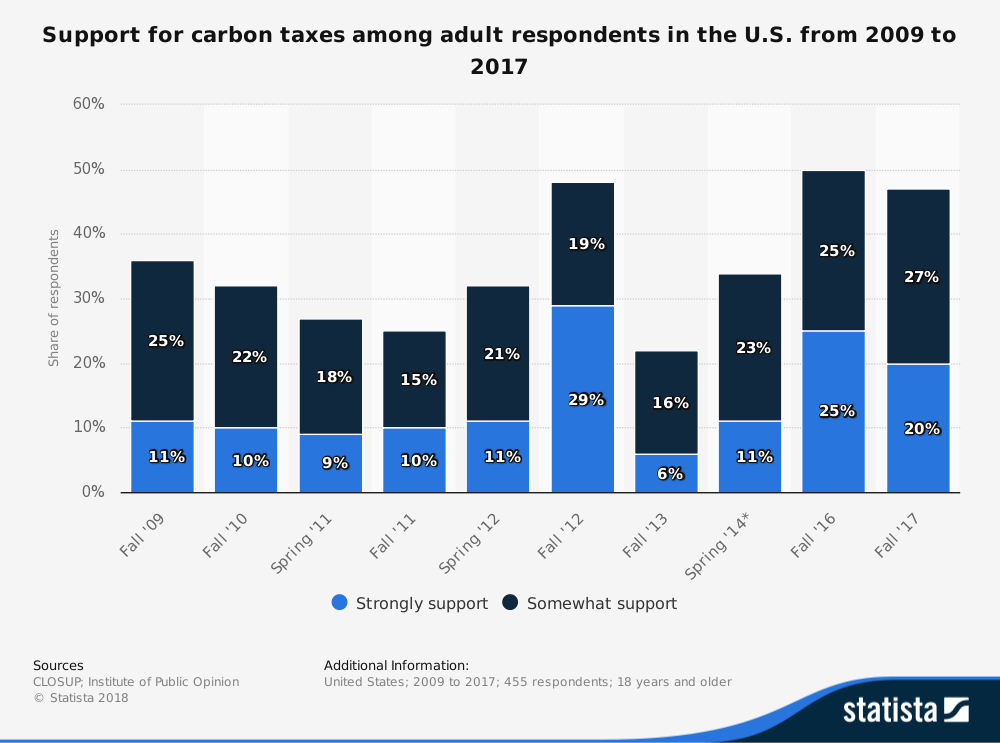

By taxing it not only would prices raise for the energy needs of consumers but there would be less overall energy consumed. Pros and cons of a carbon tax Executing the policy. Voters have stopped two carbon tax initiatives since 2010 in Washington State for this very.

The pros and cons of a carbon tax look at the reality of what occurs with this policy compared to its modeling. The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere. Political solutions to climate change are as every activist monitoring the COP negotiations should know by now largely ineffective.

Introducing carbon tax makes the firms or individuals to secretly pollute the environment in order to avoid paying the taxes. Alternative energy sources are very expensive still since the technology is relatively new. Inadequate capital limits the implementation and functioning of the carbon tax.

In theory the tax will reduce pollution and encourage more environmentally friendly alternatives. Arguments for a Carbon Tax. For example under President Trump the US left the Paris agreement on global warming.

A carbon tax could raise a lot of money. Pros and Cons of Carbon Tax. The purpose of a carbon tax is to reflect the true cost of burning carbon.

An argument made by business is that carbon taxes will discourage investment and reduce profitability. Encourage tax evasion. List of the Pros of a Carbon Tax.

The 2017 Treasury report calculated that a tax of 49 per metric ton of CO2 equivalent would raise 22 trillion over 10 years. Withal the positive intentions that this type of tax carries its idea still has garnered some criticisms leading to some heated debates around the world. The government could use this money to reduce other taxes or finance more projects that help combat climate change.

In theory a carbon tax should be revenue neutral. The tax rate on carbon products should be attaches to objective CO2 tonnage contributed to the atmosphere. The carbon tax is the most equitable method for carbon use to pay for its pollution.

A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution. Good for the Environment. Increased Tax Revenue.

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Pros And Cons Of Each Regional Economic Model Type For Estimating Download Scientific Diagram

27 Main Pros Cons Of Carbon Taxes E C

Carbon Tax Pros And Cons Economics Help

Pros And Cons Of Fossil Fuels Why Can Fossil Fuels Be Good

What Is Canada S National Carbon Tax And How Does It Affect Us Futurelearn

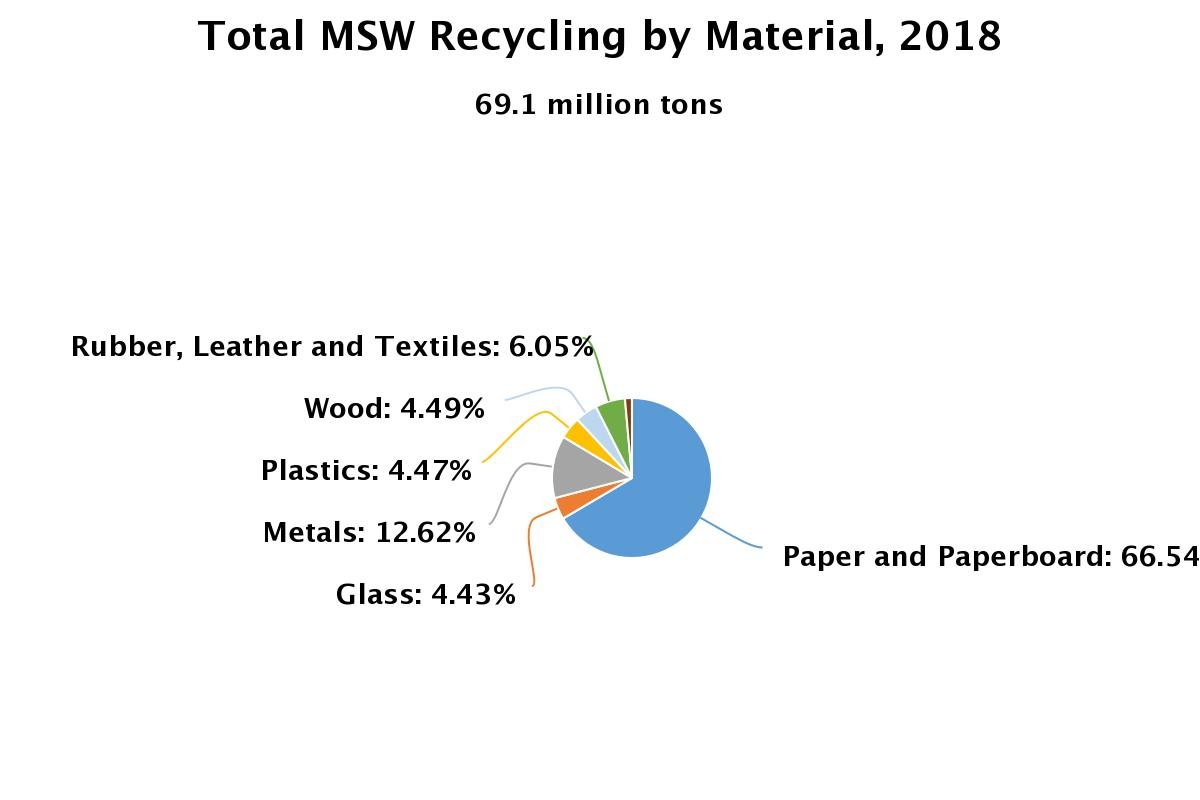

The Pros And Cons Of Paper Packaging Smartsolve

Carbon Tax Pros And Cons Economics Help

27 Main Pros Cons Of Carbon Taxes E C

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

Factbox Carbon Offset Credits And Their Pros And Cons Reuters

Eu Carbon Border Tax Unnecessary For Now But Still A Good Idea Article Ing Think

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

27 Main Pros Cons Of Carbon Taxes E C

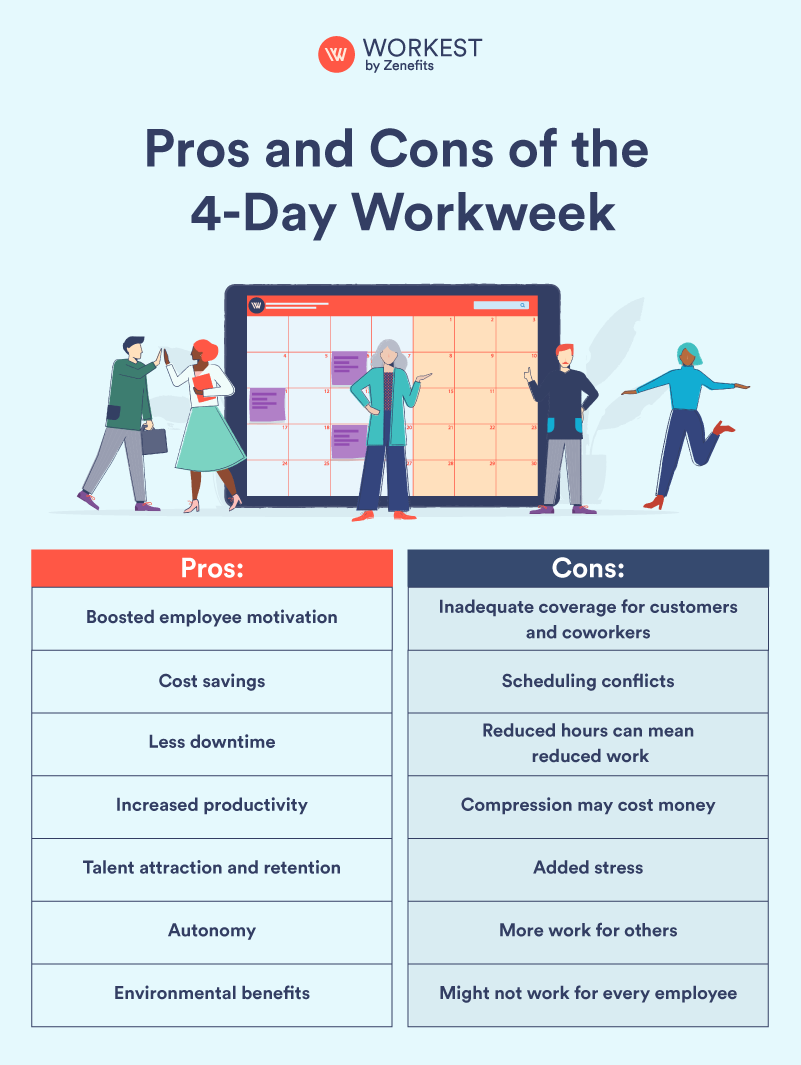

The 4 Day Workweek Pros And Cons Workest